Earthmoving equipment finance tailored to suit your requirements, not the bank's!

Talk to our commercial team about what you want to achieve.

We work with you to find the best solution for your requirements.

Simply good customer service and the best outcome for you!

Contact us!

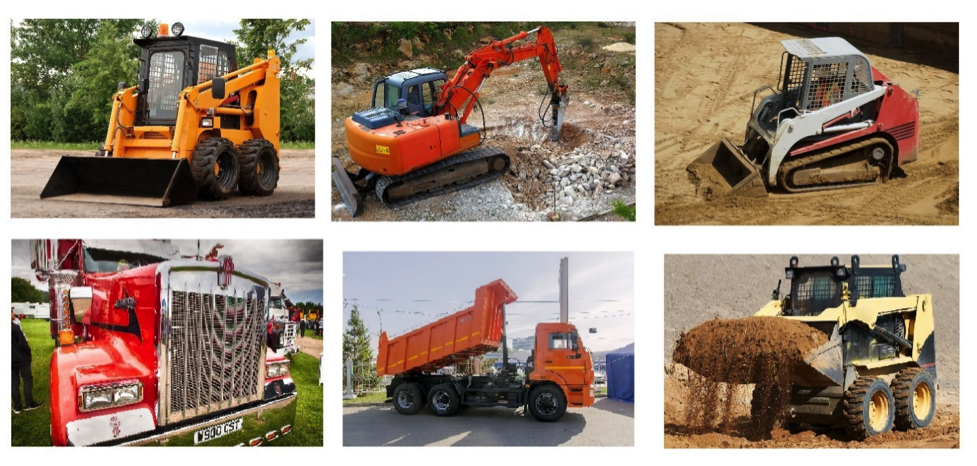

If you’re looking at a new excavator, bobcat, skidsteer, attachments, trailer or truck, call us today! We are the experts in commercial equipment finance!

We can help with the following:

Low-doc loans

Chattel mortgages or leases

Rent-to-own

Day-one-old ABNs or start-ups

Private sale

Low rates

Cash flow loans

Accounting services & business plans

Equipment insurance & business insurance

Warranty

What you can expect from us:

Understanding

We want to understand your earthmoving business and objectives by working alongside you, getting a clear picture of what you want and the equipment you may need.

Options

Once we know your objectives, we do a thorough analysis of options and prepare the best solutions available in the marketplace for you to choose from, from chattel mortgages, leases, cash loans and rent-to-own options.

Documents

After selecting the most beneficial option, we start preparing the documents, always keeping your objectives in mind.

Achievement

We now put your plan into action and execute the best solution for you. We want to be your partner for future needs by maintaining a fantastic relationship.

Why use Aim4Finance?

- Commercial property, construction, development, joint venture and short-term solutions

- Smart business loans for start-ups and existing businesses, overdrafts, line of credit and business loans

- We specialise in franchise funding, equipment, and franchise fees all in one loan

- Cash-flow loans, we have access to up to 5-year terms cash in your bank

- Car, truck and machinery finance packages available for chattel mortgages, operating leases, rentals and novated leases

- Compare commercial finance with other lenders

- Find out if you qualify for finance without accessing your credit file, free of charge

- Referral to a licensed specialist to assess your needs and requirements

- Assess how much you can borrow

- Choose your monthly payment options

Bankrupt, bad credit or defaults?

- No worries, a licensed specialist can go over all your options

- Access to lenders that deal with bad credit

- Guidance and help throughout the process